5 Easy Facts About San Diego Home Insurance Shown

5 Easy Facts About San Diego Home Insurance Shown

Blog Article

Safeguard Your Home and Enjoyed Ones With Affordable Home Insurance Plans

Importance of Affordable Home Insurance Coverage

Securing budget-friendly home insurance coverage is essential for guarding one's building and monetary wellness. Home insurance coverage offers defense versus numerous risks such as fire, burglary, all-natural disasters, and individual liability. By having a detailed insurance coverage strategy in position, house owners can rest guaranteed that their most significant financial investment is safeguarded in case of unpredicted circumstances.

Cost effective home insurance coverage not only provides monetary protection but likewise supplies assurance (San Diego Home Insurance). In the face of climbing building values and building and construction expenses, having an affordable insurance plan ensures that property owners can quickly restore or repair their homes without dealing with significant monetary problems

Furthermore, affordable home insurance policy can likewise cover personal valuables within the home, using repayment for items harmed or taken. This coverage extends past the physical structure of the home, securing the contents that make a home a home.

Coverage Options and Limits

When it involves coverage limits, it's vital to recognize the maximum amount your plan will certainly pay for each and every sort of insurance coverage. These limitations can click site differ depending on the policy and insurer, so it's necessary to assess them carefully to ensure you have sufficient security for your home and properties. By recognizing the insurance coverage alternatives and restrictions of your home insurance plan, you can make educated choices to protect your home and loved ones efficiently.

Variables Influencing Insurance Costs

Numerous variables significantly affect the expenses of home insurance policies. The place of your home plays a critical role in identifying the insurance premium.

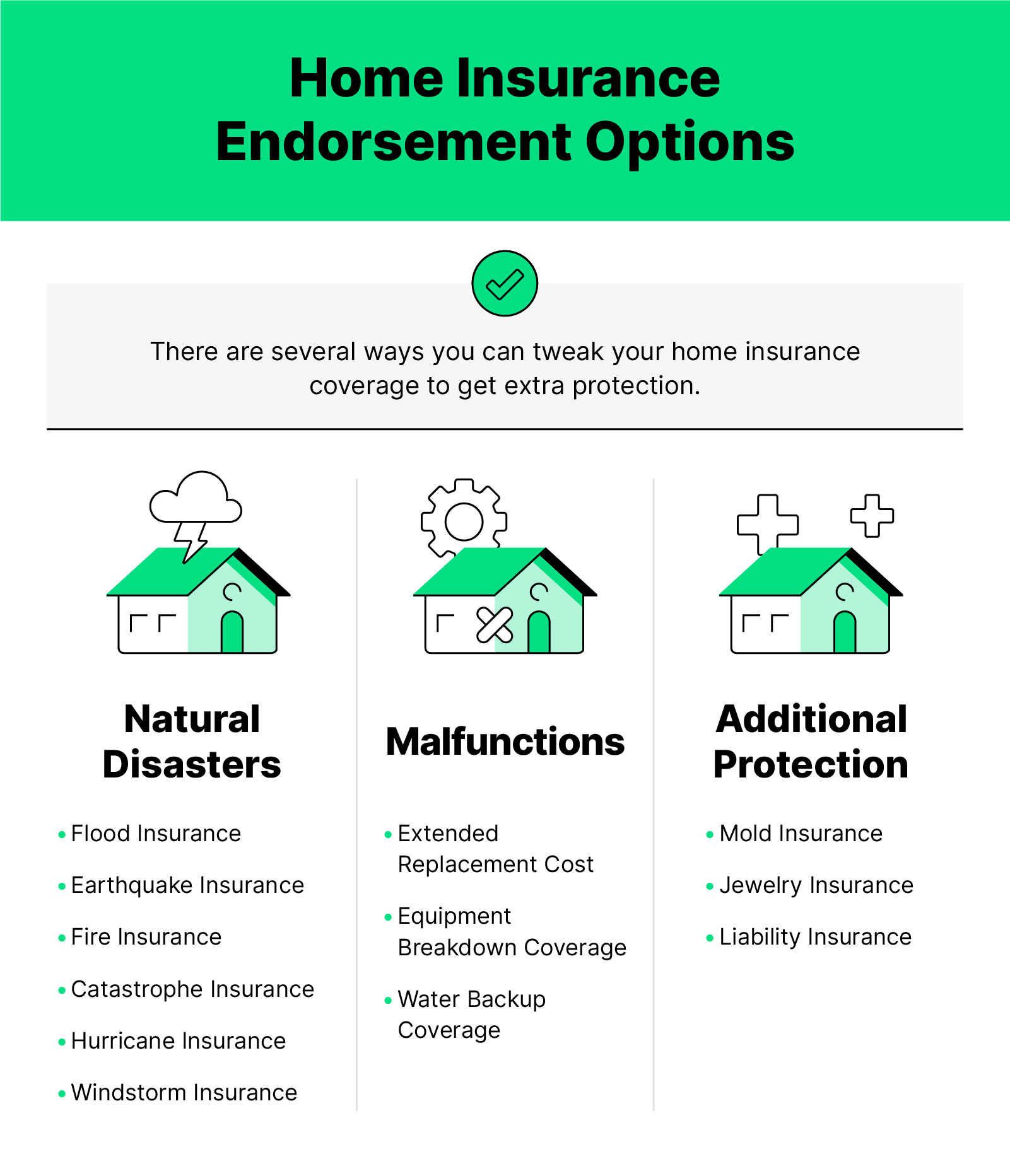

Additionally, the kind of insurance coverage you choose directly influences the expense of your insurance coverage. Going with added protection options such as my link flooding insurance or quake coverage will raise your premium. Choosing higher protection restrictions will result in higher expenses. Your deductible amount can additionally influence your insurance policy costs. A higher deductible typically implies reduced costs, but you will certainly have to pay even more out of pocket in the event of a claim.

In addition, your credit history, declares background, and the insurer you choose can all affect the cost of your home insurance coverage policy. By considering these aspects, you can make enlightened choices to help manage your insurance costs efficiently.

Comparing Quotes and Providers

Along with contrasting quotes, it is critical to evaluate the credibility and economic stability of the insurance coverage providers. Search for client evaluations, ratings from independent agencies, and any kind of history of issues or regulative activities. A trustworthy insurance company must have a great record of without delay refining cases and giving outstanding client service.

Additionally, think about the details insurance coverage features provided by each company. Some insurance firms may use fringe benefits such as published here identification burglary protection, tools malfunction protection, or protection for high-value products. By carefully comparing suppliers and quotes, you can make a notified decision and choose the home insurance coverage strategy that finest satisfies your demands.

Tips for Reducing Home Insurance Policy

After extensively comparing quotes and service providers to discover the most appropriate coverage for your needs and budget plan, it is prudent to explore effective techniques for saving on home insurance coverage. Lots of insurance coverage companies supply discount rates if you acquire multiple policies from them, such as combining your home and automobile insurance policy. On a regular basis evaluating and updating your policy to reflect any changes in your home or conditions can ensure you are not paying for protection you no longer requirement, assisting you conserve cash on your home insurance premiums.

Conclusion

In final thought, safeguarding your home and loved ones with affordable home insurance is crucial. Implementing pointers for saving on home insurance policy can also aid you protect the necessary protection for your home without damaging the financial institution.

By deciphering the complexities of home insurance coverage plans and discovering practical techniques for securing cost effective insurance coverage, you can make sure that your home and loved ones are well-protected.

Home insurance policy plans typically offer a number of coverage choices to shield your home and items - San Diego Home Insurance. By understanding the insurance coverage choices and limitations of your home insurance coverage plan, you can make enlightened decisions to secure your home and liked ones efficiently

On a regular basis examining and updating your plan to show any adjustments in your home or scenarios can ensure you are not paying for insurance coverage you no longer requirement, helping you conserve cash on your home insurance policy premiums.

In conclusion, safeguarding your home and loved ones with affordable home insurance policy is crucial.

Report this page